In the world of business, we’re bound to encounter our fair share of shady dealings. Picture this: your customer is ordering, but their delivery address doesn’t match the address on their card. Red flag, isn’t it? Or, your loyal customer, Joe, is suddenly going all out with a massive order. That doesn’t sound like your usual Joe. And here’s another head-scratcher – orders are raining in, but they’re all small fries in terms of money.

You might think, “Hey, these are dodgy orders!” And you’d be right. But here’s the twist – if you pull the plug on these orders just to be safe, you might end up shooting yourself in the foot with what we call “false positives.” It’s a fine line to walk in the business world.

Let’s break down false positives into plain and simple terms. For example, your email’s spam filter wrongly marks a legitimate message as spam – a false alarm.

In the financial world, however, the “false alarms,” or false positives, mean your transaction monitoring systems are flagging your legal transactions as illegal.

On the flip side, we’ve got false negatives – these are sneaky. They’re illegal transactions that somehow slip through without triggering the “Hey, something’s fishy!” alert.

False positives often occur when a business says, “Hold on, this order seems fishy!” and they decline it. But here’s the kicker: it’s not always confirmed fraud – it’s just a suspicion. Whether you call them false positives, sales insults, customer insults, or false declines, they’re a real headache.

Why? Well, it’s about more than losing money, which is bad enough. It actually messes up your entire digital customer journey and your customer’s long-term relationship with your brand. It affects how much they spend, how much it costs to acquire them, and whether or not your customers will ever trust you again and even recommend you to family and friends. False positives are like the ghosts that haunt your business – and they’re no friendly Casper, that’s for sure!

False positives can be a real headache in the world of online (internet) shopping. Let’s break it down into even simpler terms. When you, as a customer, decide to buy something online, you go through a few steps. First, you become aware of what you want to buy, then you think about it; next, you buy it, and finally, you keep coming back for more if you’re happy with your experience.

Now, out of these steps, the one where false positives love to cause trouble the most is when you’re making the actual purchase. At this point, you’ve already thought about what you want, compare your options on different websites, and finally decided to add items to your online shopping cart. You’re all set to make a purchase.

In the online world, you make purchases without your physical credit card, which is what we call CNP, aka “card-not-present” transactions. Here’s where things get tricky. You see, false positives tend to mess up these card-not-present transactions more than anything else.

To put some numbers on it, when you’re buying something in a physical store, your card gets approved around 97% of the time. But when it comes to online shopping, especially the part where you’re not handing your card over in person, that approval rate drops to around 80% to 85%, a 17.5% decrease!

The time it takes for you to reach the point where you’re actually buying something online can vary depending on what you’re buying or where you’re buying it from. It’s quicker to order sushi online than it is to buy a new TV, right? But here’s the catch: businesses that don’t think about the time you spend getting to the buying stage are making things harder for you, and they need to make some serious money. So, false positives disrupt the whole shopping experience and can end up costing businesses a lot.

False Positives Silently Kill Businesses

Businesses have a lot at stake when it comes to false positives. Just one false alarm can scare away loyal customers and their close circle of friends and family. In fact, a whopping 25% of Americans have admitted they’d abandon a website / E-Shop that wrongly rejects them and takes their business (Money) elsewhere. The damage, however, doesn’t stop there, as false positives pack a financial punch in 4 key ways:

Immediate Revenue Hit: Among businesses keeping a close eye on false positives, around 60% estimate that their rejection rate falls between 1.1% and 5%. To put it in perspective, if a business earns $50 million in annual revenue, it could wave goodbye to up to $2.5 million due to false positives.

Loss of Customer Lifetime Value: Customer lifetime value represents the profit a business expects from all future customer purchases. When legitimate customers get turned away wrongly, they might never return, leading to long-term losses.

Wasted Acquisition Costs: Acquiring a customer involves hefty costs, including market research and advertising. Imagine a business splurging $100 to guide a customer through the sales funnel only to decline their order. In such cases, they not only miss out on revenue but also kiss goodbye to that $100 invested in advertising.

Brand Damage: In today’s age of social media and viral word-of-mouth, a single customer’s bad experience with a false positive can spread like wildfire, reaching thousands of potential and existing customers. This can tarnish a brand’s reputation faster than you can say “false positive.”

It’s clear that false positives are more than just a minor bump in the system; they are a significant threat that businesses must address with the fullest seriousness, intention, and tools.

Unlocking the Power of ThetaRay AI for a Smoother Customer Journey

To summarize, false positives can be extremely detrimental to businesses and financial institutions. They can seriously hurt your net profits and operational costs and damage your reputation. It’s not just a small issue – it can hit you where it hurts, causing problems with your revenue, customer relationships, and your brand’s reputation.

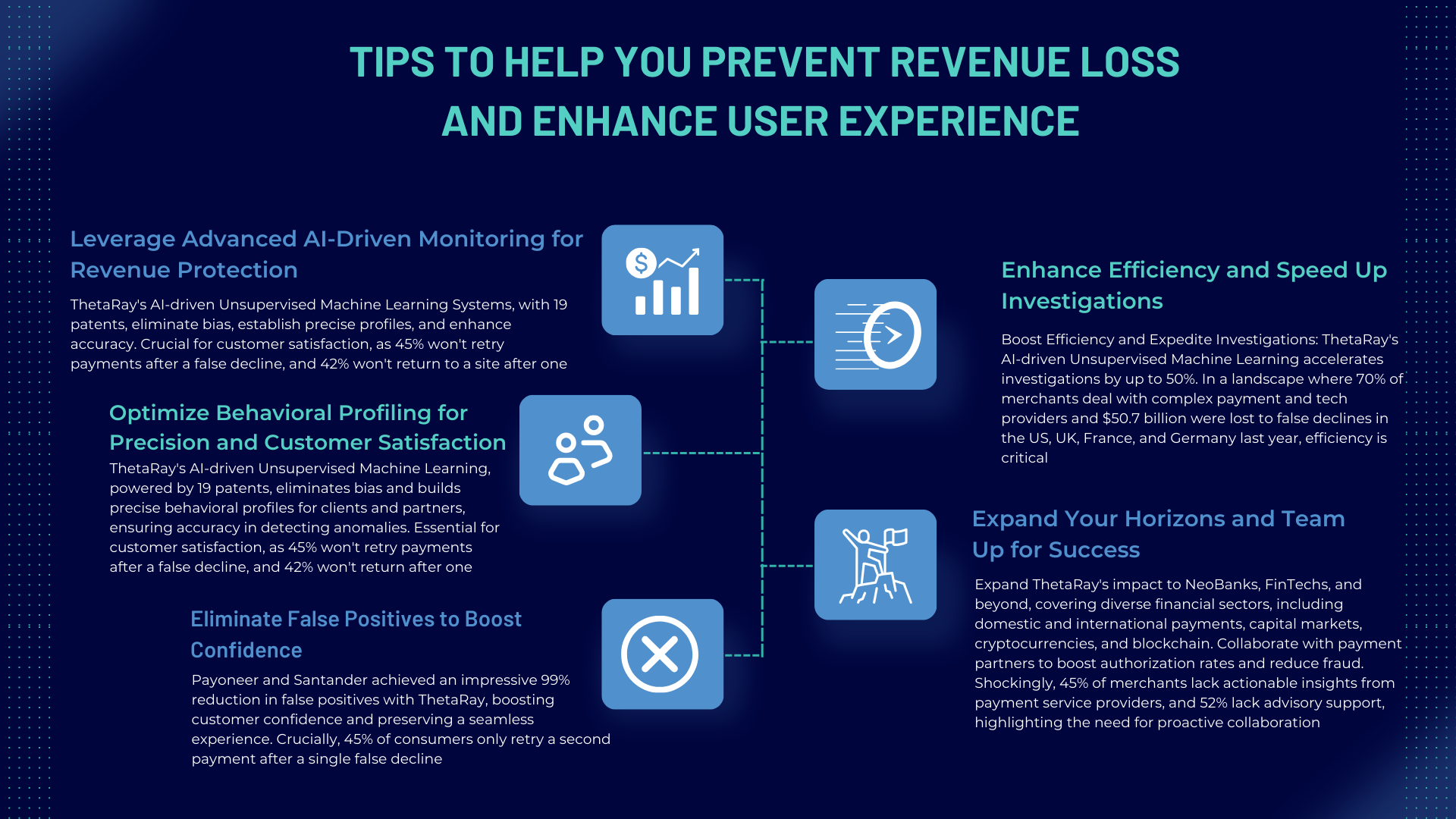

When exploring the world of cutting down on false positives and closing gaps for compliance operations, don’t just think about protecting your cash. It’s equally as important to give your customers an awesome experience and make sure your business keeps growing. With ThetaRay in your corner, you’ll be all set to face the challenges and make sure your customers have a smooth and successful journey.

Written by Jacob Beltser,

Written by Jacob Beltser, EU & APAC FinCrime and AML Market Leader at ThetaRay