ThetaRay Blog

Read insights and opinions from ThetaRay on financial crime detection

Featured

October 9, 2024

Starling Bank’s Screening Failures — A Lesson in Compliance

Read more

July 30, 2024

Measuring Screening Success

Read more

AI

Beyond the Basics — A Multi-layered Approach to Transaction Monitoring

In the rapidly evolving world of fintech and banking, the stakes have never been higher when it comes to ensuring the integrity of financial transactions. As financial crime grows more sophisticated, the traditional methods of transaction monitoring have proven inadequate. It’s time to think beyond the basics and explore a multi-layered approach that not only […]

-

The Fintech & Banking Event

Navigating Ghana's Compliance Challenges with AI Technology

February 15th

09:30 - 14:00

Kempinski Hotel Gold Coast City Accra, Ghana

Register Now -

July 17, 2024

AI-Powered AML: A New Era for Correspondent Banks

Correspondent Banking has always been considered a high-risk area for banks due to the nature of international money flows and the multiple jurisdictions of regulations to adhere to.

Read more

-

Beyond Borders: AI Tackles Global Banking Challenges

In the realm of global finance, correspondent banking plays a pivotal role, facilitating transactions between financial institutions across borders.

Read more

-

July 11, 2024

AI in Correspondent Banking: Overcoming Complex Threats

Staying ahead of complex illegal activities has become a formidable challenge for compliance officers and risk managers.

Read more

-

July 10, 2024

The Compliance Officer’s Guide to AI: Insights from the Wolfsberg Statement

Let’s take a look at the latest Wolfsberg Group Statement on “Effective Monitoring for Suspicious Activity” 2024 and see what it means for us in the world of anti-money laundering (AML) and countering the financing of terrorism (CFT).

Read more

-

June 6, 2024

ThetaRay Transaction Monitoring Solution: Combating Human Trafficking with Tailored Detection

In the unrelenting fight against human trafficking, artificial intelligence, specifically machine learning, has emerged as a powerful tool revolutionizing how financial institutions detect and combat this abhorrent crime. We had the privilege of sitting down with Gal Bar, ThetaRay Transaction Monitoring Product Manager, who shed light on our cutting-edge approach leveraging tailored models to identify […]

Read more

-

June 2, 2024

Customer Risk Assessment with AI: Insights from ThetaRay’s experts

Vered Gottesman, CMO at ThetaRay, and Nitzan Solomon, VP of Product at ThetaRay talk about our latest product innovation: ThetaRay Customer Risk Assessment.

Read more

-

May 7, 2024

Cracking the Code: Supervised vs. Unsupervised Machine Learning

In this evolving world of financial crime detection where AI and ML play a pivotal role in unraveling the complexities of illicit activities, there is a debate and perhaps confusion over which technique should be applied to best resolve the problem. Among the arsenal of ML techniques, two prominent methods stand out: unsupervised and supervised learning.

Read more

-

April 1, 2024

Canada is Raising the Bar on Anti-Money Laundering and Counter-Terrorist Fundraising Compliance

Scrutiny of the anti-money laundering (AML) and counter-terrorist fundraising (CTF) practices of Canadian banks and institutions has many questioning whether enough is being done to defend against current threats. Recent non-compliance findings by the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) imply there is room for the private sector to do better. In […]

Read more

-

March 27, 2024

Remittance Service Providers Need Automated Crime-Fighting Solutions More Than Ever: Here’s Why

Remittances are an essential way to bring money into low-income countries and unbanked communities, but they are all-too-frequently used as a conduit for financial crime. By nature, money transfer and remittance are high-risk businesses. Therefore, to ensure that financial crime is detected, banks and fintechs traditionally use rules to monitor transactions which may catch some […]

Read more

-

AML

February 5, 2024

How AI-Driven Customer Risk Assessment (CRA) is Transforming CDD

CMO Vered Gottesman asks CPO Dagan Osovlansky about ThetaRay’s new CRA product Vered: ThetaRay just launched CRA – Customer Risk Assessment. What differentiates ThetaRay’s CRA from existing customer due diligence products on the market? Dagan: Customer due diligence (CDD) requires a comprehensive process covering multiple aspects of understanding the customer. ThetaRay’s CRA product focuses on […]

Read more

-

AI Technology

January 15, 2024

Anti-Money Laundering (AML) New Year’s Resolutions

Top Five Things Organizations Can Do to Modernize Their Approach to Addressing Financial Crime By Vered Gottesman, ThetaRay CMO

Read more

-

AML

January 14, 2024

Kicking Off 2024: The Biggest AML Penalties of 2023

As we delve into 2024, it's crucial to reflect on the significant AML penalties of the past year. 2023 witnessed some of the largest fines in the industry, signaling a vital wake-up call for financial institutions

Read more

-

November 22, 2023

The Hidden Costs of False Positives And How They Impact Your Bottom Line

In the world of business, we're bound to encounter our fair share of shady dealings. Picture this: your customer is ordering, but their delivery address doesn’t match the address on their card. Red flag, isn’t it? Or, your loyal customer, Joe, is suddenly going all out with a massive order. That doesn’t sound like your usual Joe. And here's another head-scratcher – orders are raining in, but they're all small fries in terms of money.

Read more

-

November 13, 2023

Cracking Financial Crime: OpenAI Solution for a Futuristic Investigation Makeover

In today's ever-evolving landscape of financial crime, the integration of AI capabilities has become not just an option but a necessity. This strategic alliance between artificial intelligence and human analysts has the potential to revolutionize the way we approach financial crime investigation and reporting. At ThetaRay, we understand the power of AI in this critical domain and have embarked on a groundbreaking collaboration with the technology based on OpenAI to redefine the rules of the game.

Read more

-

AI

September 10, 2023

Grey List / Black List Update 2023

The Grey List and the Black List, created by the Financial Action Task Force (FATF), categorize countries based on their perceived risks and compliance with international standards in countering financial crimes. The FATF is an intergovernmental organization established to combat money laundering, terrorist financing, and other financial crimes globally. The Grey List The Grey List, officially […]

Read more

-

August 3, 2023

AML in the US Market – Navigating the Path for Growth or Sinking Boat?

Recent incidents of bank collapse, hefty fines, and sanctions against the crypto market have highlighted the gaps between the strictness of the regulatory environment in the US and common risk management standards. While the expectations are clear, banks and financial service providers are still struggling to effectively manage risks, particularly in Anti-Money Laundering (AML). […]

Read more

-

July 20, 2023

Unraveling the Distinction: Fraud vs. Money Laundering

In the world of financial crimes, two terms stand out prominently – fraud and money laundering. Both illicit activities have far-reaching consequences on individuals, organizations, and even entire economies. Understanding the nuances between fraud and money laundering is crucial in combatting these threats effectively. In this blog, we will delve into the fundamental differences between […]

Read more

-

June 15, 2023

Mark Gazit passes the baton to Peter Reynolds, who has been appointed as the next CEO of ThetaRay.

Peter Reynolds, a Fintech Industry Veteran, who served as Thetaray’s Chief Revenue Officer (CRO), alongside Mark Gazit, for the past two years, will now lead the company for continued strong international expansion. Hod HaSharon, June 15, 2023 – ThetaRay, is a category leader, providing AI-powered transaction monitoring solutions, servicing leading global banks, FinTechs, and regulators. […]

Read more

-

June 12, 2023

Money Laundering Fines and Punishments by Country: A Global Overview

With governments and regulatory bodies worldwide cracking down, financial institutions have a responsibility to ensure that transactions are safe and secure from money laundering, a pervasive financial crime with severe consequences for local and global economies. Understanding the potential damage money laundering can cause a business is key to determining your AML strategy and […]

Read more

-

AI

April 13, 2023

Overcoming SEPA payment AML challenges with advanced AI

The Single Euro Payments Area (SEPA) initiative is helping facilitate the free flow of payments and reduce the complexity of cross-border payments within Europe. SEPA zone benefits are numerous, but these payments are also creating new challenges for financial institutions and payment service providers to implement effective AML programs. Regulated by the European Payment Council […]

Read more

-

AI

March 23, 2023

Fintechs in the UAE ensure success with tools for trust

The new normal of digital banking post-Covid-19 is driving fintech growth in the UAE, where online payment platforms are improving accessibility to help resolve a pressing need for financial inclusion. Cross-border payments are a necessity in the UAE where migrant workers make up 90% of the workforce. Outflows from the UAE reached $43.2 billion in […]

Read more

-

AI

February 13, 2023

Restoring Trust in the Financial System with AI

Financial institutions are seeking more advanced technology that can protect their networks against money laundering and cybercrime and enable them to increase profits. ThetaRay is rising to the challenge of helping banks and fintechs with unique and powerful AI (Artificial Intelligence) solutions that can imitate human intuition. Today’s financial crime is sophisticated cybercrime, and it […]

Read more

-

AI

December 28, 2022

How AI can help your AML get unstuck in 2023

The uphill battle against money laundering and financial crime in 2022 was marked by progress in some areas but offset by a mountain of new challenges. In fact, progress in AML programs appears to be “stuck,” according to the Basel AML Index which ranks money laundering and terrorist financing risks around the world. The 2022 […]

Read more

-

Sanction Screening

December 21, 2022

Riding through the sanctions storm with AI

Compliance professionals have surely had a very stressful year in 2022 with the extra burden of transaction screening work, amid a 95% jump in sanctions list updates due to the Russia-Ukraine war. This regulatory pressure is not expected to fade away in 2023 with new sanctions packages being approved and sanctions evasion set to become […]

Read more

-

AI Technology

December 7, 2022

Harness the Gulf economic boom with AI technology

The Middle East, at a crossroads between Europe, Africa, and Asia, is playing an increasingly global role on the financial scene. Today, the United Arab Emirates (UAE) serves as a financial hub in the region, with commerce, banks, and fintech operating out of Abu Dhabi and Dubai. UAE fintech is also leading in the region, with a […]

Read more

-

October 25, 2022

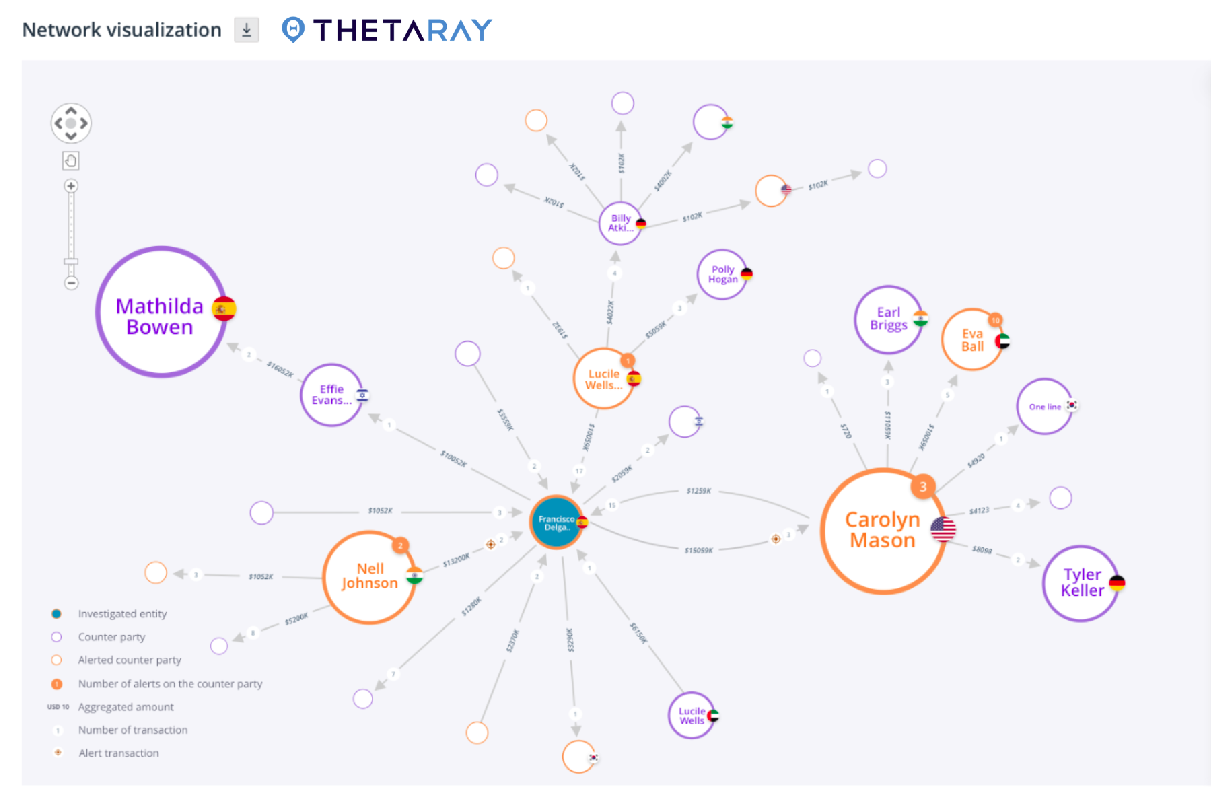

See the big picture in the AML details

Embrace network visualization tools for more effective AML compliance in an increasingly complex financial world By Dagan Osovlansky, ThetaRay Chief Product Officer Fintechs and banks are struggling today to operate effective and efficient anti-money laundering (AML) and combating the financing of terrorism (CFT) programs, especially with the complexity of cross-border payments driven by new online platforms. As digital payment […]

Read more

-

AI

September 19, 2022

What is Trade-Based Money Laundering?

The mounting challenge of trade for AML compliance Trade financing is a big business for banks, with letters of credit and an important revenue stream. For the developing world, global trade is key to economic growth. The global trade finance market, with an estimated value of $5.2 trillion, facilitates the cross-border movement of goods and […]

Read more

-

AI

September 8, 2022

ThetaRay AI Tech to Monitor African Payments for ARCA

Nigerian fintech selects SONAR SaaS solution for AML and sanctions screening to create new revenue opportunities and boost customer service. ThetaRay, a leading provider of AI-powered transaction monitoring technology, today announced that ARCA, a premier African payment services provider, will implement ThetaRay’s advanced SONAR SaaS anti-money laundering (AML) and sanctions list screening solution for transactions […]

Read more

-

AI

August 28, 2022

4 AML takeaways from LATAM’s fintech scene

The Latin American payment fintech market is growing rapidly with new digital platforms fulfilling the needs of underserved financial consumers in the region. The region is enjoying phenomenal growth, with the number of firms reaching nearly 2500 in 2021 from 700 five years ago, according to data from Finnovista. Brazil and Mexico alone host a […]

Read more

-

AI

July 26, 2022

Glass Boxes – Under The Hood of AI Transaction Monitoring

Next-generation transaction monitoring tools that use AI and ML technologies are getting faster and more accurate, drastically cutting the number of false positives. Yet fear and suspicion around the “black box” nature of AI is still keeping potential adopters away from these technologies. Black box AI refers to a problem in machine learning whereby it […]

Read more

-

AI

July 24, 2022

4 Key Criteria For Choosing Your Transaction Monitoring Software

Fintechs rely on transaction monitoring software to secure their innovative platforms against increasingly sophisticated financial crimes. They have an obligation both to their customers and to regulators to ensure their financial business is not exploited by criminals. But in the fast-moving and agile world of fintech, they can’t afford to adopt software solutions that slow […]

Read more

-

AI

July 12, 2022

5 Misconceptions About AI-Based AML Programs

The industry is on a search for new technologies to manage AML compliance, with AI top of mind now that fintech events are taking place again around the world. Hesitation around making the transition from a rules-based to an artificial intelligence-driven solution can be caused by misconceptions about the methodology of an AI-based program. Here are […]

Read more

-

January 13, 2022

3 ways AI can help prevent AML compliance fines in 2022

2021 was another bumper year for fines slapped against financial institutions (FIs) for failures in anti-money laundering (AML) compliance. AML shortcomings in transaction monitoring are a global problem. Countries whose banks were hit with fines include the United States, Germany, the Netherlands, Norway, Latvia, France, the UAE, India, Malaysia, and South Africa. Fines imposed on […]

Read more

-

December 3, 2021

Forces driving demand for RegTech

RegTech is getting more attention in the fintech ecosystem this year, alongside the surge in cross-border money transfers and expansion of digital transfer platforms. Accelerated by the COVID-19 pandemic, the popularity of electronic payments is spiking both the volume and complexity of financial transaction data. More sophisticated digital financial crimes are another side effect of […]

Read more

-

November 22, 2021

How to ride through the holiday season without too many obstacles

Black Friday, Cyber Monday, Cyber Week, Black November, Christmas and New Year’s vacations, aka the commercial part of the “Holiday Season.” For shoppers, retailers, and holidaymakers, it’s one of the most satisfying times of the year. For banks and payment service providers, however, the surge in spending and transactions that comes with this peak season […]

Read more

-

November 17, 2021

Reaping the benefits of lowering money-transfer fees

Competition is heating up in the low-cost international money transfer business, with new fintechs putting pressure on the traditional MTOs and incumbent banks. It’s the 31st of the month. A migrant worker working in the Gulf waits in his employer’s office to receive his monthly wages. With cash in hand, Step 2 is the dash […]

Read more

-

November 4, 2021

The Dark Art of Money Laundering

Art is an increasingly attractive avenue for money launderers, and legislators have taken notice Deep in the night at a major European port, a high-end security company guard is on his shift in a warehouse watching over multi-million-dollar art pieces held in storage. Unbeknownst to him, one of the artworks has just changed hands right […]

Read more

-

October 19, 2021

Money Laundering Through Mobile Apps

The first money laundering activities to run through mobile apps took place over ten years ago when 20 of the top 25 downloaded applications in the Danish Apple App Store were downloaded from China and cost between $50 and $100 each. The laundering activity was fairly simple. Criminals created the apps, and used stolen gift […]

Read more

-

September 22, 2021

Banks Are Forfeiting Revenue By Eschewing Correspondent Banking

Correspondent banking is a vital system that helps to connect smaller and underdeveloped communities to the world’s financial ecosystem. In the last decade or so, the need for correspondent banking has boomed across the globe. The global pandemic further kicked this increase into overdrive, with many people needing to transfer money to loved ones abroad. […]

Read more

-

September 9, 2021

Reopening Revenue Streams

On its surface, de-risking banking activities is a justifiable move. Rather than attempt to manage the risk, banks choose instead to avoid risk. With that move, they sidestep past onerous regulator penalties, reputation-tarnishing headlines, and angry shareholders and customers. The result, of course, is predictable. Banks find themselves in the clear but watch as revenue […]

Read more

-

August 16, 2021

Finding the Unknown Unknown

There is a great romanticism about the unknown unknown. It sits there on the edge just beyond our knowledge and understanding. North America, before Columbus sailed there in 1492, was an unknown unknown to Europeans. Travels can take us to unknown places, and while there, we often find ourselves face to face with cultures and […]

Read more

-

August 8, 2021

Overcoming Limitations in Transaction Monitoring

When I began my career, back in the late 90s, I was hyper-focused on rule-based technology and methodology. Rules represented our best chance at using automation to monitor transactions and prevent money laundering and other financial crimes. Two decades have passed, and it’s easy to see how wrong I was. At its very best, a […]

Read more

-

October 12, 2020

The Unbearable Ease of Laundering Money

With over 4000 leaked SARS that were involved with 2000 banks, turns out most of the SARs were related to cross border activity, a well-known “blind spot” in the banking world. Over the past several years, large schemes revealed the financial systems failure- with billions of dollars remaining undetected and unreported. The list of SARs […]

Read more

-

September 2, 2020

The Bad Actors are Taking the Correspondent Banking Route

Global economy is facing real challenges with cross border payments, Financial Institutions lost trust in their counter-parties and their AML controls, De-risking and slow business are no longer needed-with ThetaRay financial institutions can gain trust back and support growth with confidence.

Read more

-

September 18, 2019

What’s Worse Than the Unknown? The Unknown Unknown

Across the globe, the C-suite of financial institution fear the unknown. In fact, most of us fear the unknown but FI executives can get into serious regulatory, legal, financial and reputational hot water – especially with unknown unknowns. What do I mean by that? In simplest terms, an unknown unknown is an unspecified threat that […]

Read more

-

September 9, 2019

Using Practical Data Science to Solve Real-World Correspondent Banking Challenges

I think you all know that correspondent banks are required to meet specific regulatory obligations while maintaining their correspondent relationships, as well as meet general compliance obligations to report suspicious activity, prevent money laundering, and comply with economic sanctions. A mouthful but true, nonetheless. Although the Legacy AML and traditional AI systems, in place at […]

Read more

-

August 28, 2019

What do Quantum Physics and Correspondent Banking Relationships Have in Common?

My banker told me that, in theory, managing his relationship with regulators and respondent banks is straightforward. Then he paused and said, “Actually, about as straightforward as explaining quantum physics to a five-year old.” And he’s right. Both understanding quantum physics and correspondent banking relationship obligations are tough. Quantum Physics makes sense of the smallest […]

Read more